Profit First is a system of accounting that put simply, prioritizes profit. Businesses that use this method set aside a percentage of profit first, and then determine how many expenses they can afford. 💸

The system centers around the idea of literally separating your revenue into different accounts, most importantly, the profit account. Basically, you can think of it as the envelope method of personal finance applied to business.

Traditional method of accounting: sales – expenses = profit

Profit First method of accounting: sales – profit = expenses

Profit First is a groundbreaking approach because entrepreneurs are traditionally taught to focus on revenue growth, regardless of the expense. As a result, a business’s profit margin is seen as something to be optimized and improved later. Unfortunately, that can lead a business to run out of cash quickly, and ultimately, fail.

The Profit First method is so effective because it’s based on behavioral laws, like Parkinson’s Law. This law states that work will expand depending on the amount of time available to complete the work, and it can also be applied to your finances.

Parkinson’s Law is the reason that even million-dollar businesses can end up with zero dollars in their bank accounts. When you have money sitting around without a defined purpose, you’ll find a reason to spend it — that’s just human nature.

But when business owners make profit a habit, it can help them avoid overextending themselves. They’ll be able to make informed decisions about how to allocate their resources and gain more control over their financial performance.

1. Determine your profit margin

First, you need to determine what percentage of your revenue you want to allocate to profit. A common recommendation is to aim for a profit margin of at least 5% depending on your business goals and financial needs. If you can’t afford a profit margin right now, you may need to step back and re-evaluate your business budget.

2. Set up the five Profit First accounts

Next, you’ll need to set up separate bank accounts for your business, including a checking account, a profit account, and accounts for other expenses such as business taxes and owner’s pay. You may also want to set up a savings account to save for potential business emergencies.

3. Allocate revenue to each account

After profit is set aside, you’ll need target allocation percentages for each of your accounts. For example, you might aim to allocate 10% of your revenue to the profit account, 40% to the owner’s compensation account, 30% to the OpEx account, and 20% to the taxes account.

4. Pay expenses from the appropriate accounts

The last step is ensuring your expenses come from the OpEx checking account, your taxes come from the taxes account, etc. Doing this will allow you to maintain your budget without eating into your profit. It will also help you get crystal clear 💎 on how much you’re earning, spending, and saving at any given time.

Managing your business finances with Profit First can be life-changing. Instead of leaving your most important business metric up to chance, Profit First helps business owners keep their focus on profit. Here are three more benefits of using the Profit First system.

Makes prioritizing profit a habit. It’s risky to let profit be your business’s last priority. However, human nature dictates that if we see money, we’re likely to spend it. That’s why Profit First is so great: it pushes you to automatically put profit aside before you even see it in your checking account.

Helps businesses plan for the future. It can be tough to save for expenses like taxes when your business’s cash flow is inconsistent. Profit First helps by reminding you to set aside a specific percentage from every sale — even if it’s just a few dollars. Over time, that discipline will pay off.

Keeps your business organized. Business expenses can be challenging to manage. Separating your revenue into different accounts will keep you organized and simplify the process. Instead of guessing, you’ll know exactly how much money you have for OpEx, taxes, and your other goals.

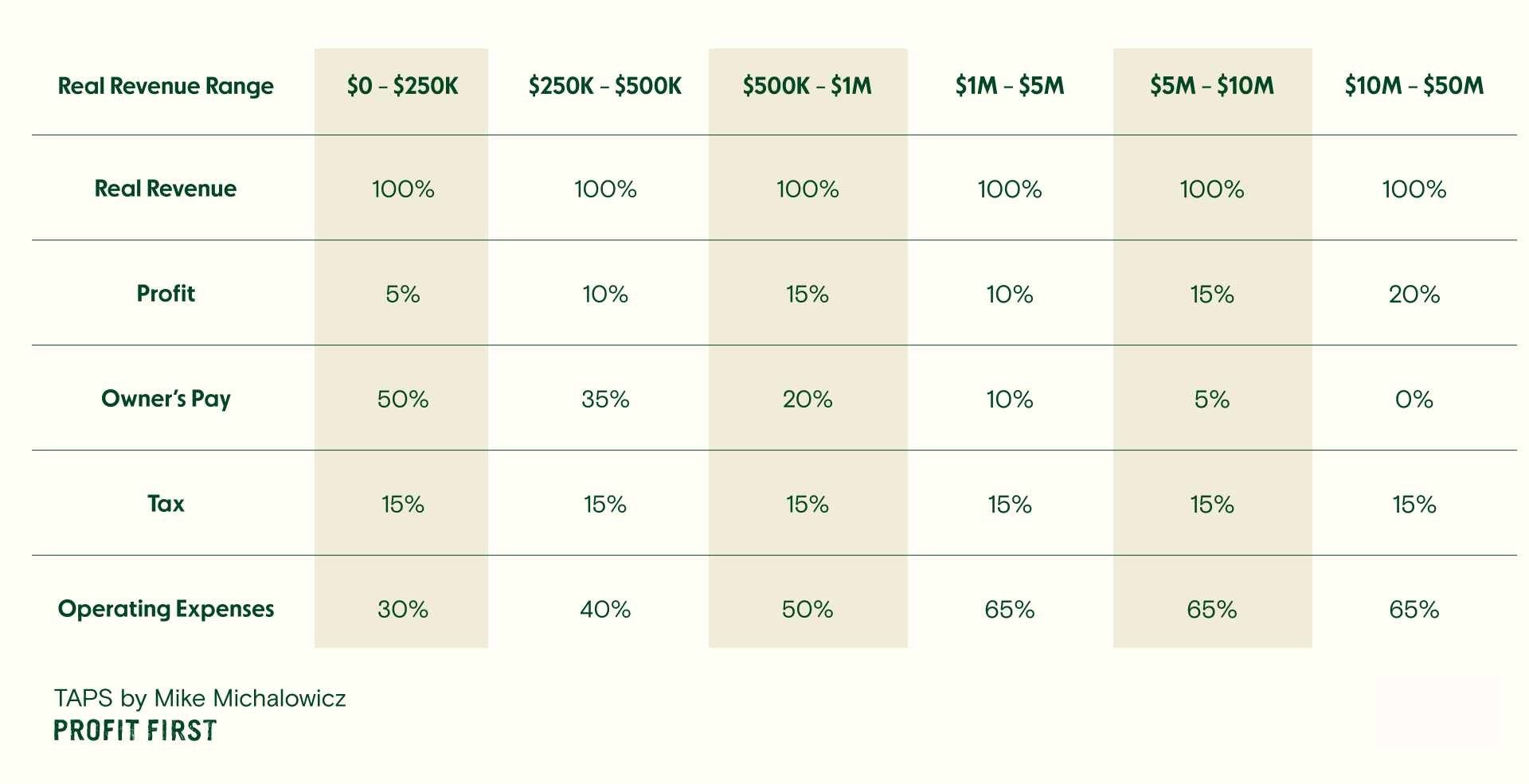

This chart by Profit First shows the recommended percentages for small businesses based on annual revenue.

ProfitPro.app provides a comprehensive suite of tools designed specifically for businesses implementing Profit First, offering a practical and user-friendly platform for managing finances in alignment with this system.