Cash management is the cornerstone of a successful small business, yet it remains one of the most complex and time-consuming tasks for business owners. In a world where financial health is paramount, simplifying these processes not only saves time but also secures a business’s future. Profit Pro emerges as a beacon of hope, offering an intuitive solution that transforms the daunting task of cash management into a streamlined, stress-free process.

The Challenge of Cash Management: Small business owners often grapple with the balancing act of managing incoming revenue against outgoing expenses. The challenges range from keeping track of payments and invoices to ensuring there is enough cash on hand to cover operational costs. This balancing act is further complicated by the need to plan for future growth, all while keeping the business afloat in the present.

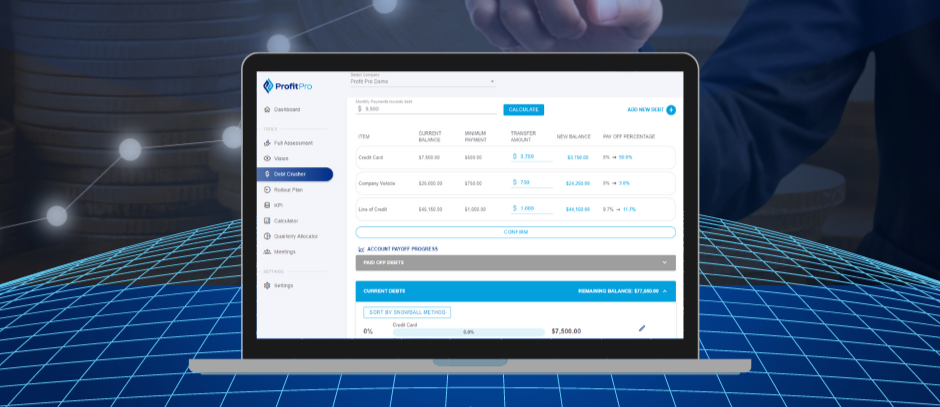

Profit Pro as a Solution: Profit Pro, designed with the small business owner in mind, offers a seamless solution to these challenges. By integrating the principles of the Profit First methodology, Profit Pro automates the cash management process, ensuring that every dollar earned is allocated efficiently to where it is needed most.

Step-by-Step Guide:

– Setting Up Your Profit Pro Account: Begin by entering your business’s financial information into Profit Pro. This includes your revenue streams, fixed and variable expenses, and any debts or loans.

– Defining Your Allocations: Profit Pro helps you determine the percentages of your revenue that should be allocated to different accounts, including profit, owner’s pay, taxes, and operating expenses, based on the Profit First methodology.

– Automating Transactions: Once your allocations are set, Profit Pro automates the distribution of incoming funds into these predefined categories, ensuring that your financial priorities are maintained.

– Monitoring Your Financial Health: The dashboard provides a real-time overview of your financial status, allowing you to make informed decisions quickly and confidently.

Benefits Realized: Businesses that implement Profit Pro experience immediate and tangible benefits. The automation of financial transactions reduces errors and saves time. The clear visibility into financial health empowers owners to make strategic decisions, and the adherence to the Profit First methodology ensures that profitability is a consistent priority.

In the complex world of small business finance, simplifying cash management is not just a convenience—it’s a necessity. Profit Pro offers a powerful solution that not only streamlines financial processes but also transforms them into a strategic asset for growth and stability. By automating and optimizing cash management, small business owners can focus on what they do best: growing their business. Discover the difference Profit Pro can make for your business today.